Q2 Magazine 2023

The role of the COO in developing and implementing ESG strategies

Armstrong Wolfe are looking to establish the current roles and responsibilities of the COO where they relate to managing and interacting with their organisation’s ESG strategy, and to offer a possible framework of solutions to facilitate productive ESG management.

In 2022, Armstrong Wolfe launched an ESG data management programme with our alliance partner Sutherland. From this programme, we concluded three things:

1. The ESG COO role is maturing, and more needs to be done to define an ESG COO’s roles and responsibilities.

2. The role of an ESG COO is to quantify, qualify or certify the data points and create due diligence around the supply chain and an ecosystem around governance.

3. Financial services organisations are reliant on financial market transactional risks versus seeing sustainability as a strategic risk. The ESG COO role would potentially lower the risk of talent attrition.

Definitions

- ESG (environmental, social, governance) refers to client activities.

- CSR (corporate social responsibility) relates to corporate activities.

These concepts meet when a bank reports and communicates to stakeholders and shareholders on its ESG activities and CSR performance.

The evolving role of the COO

A COO who manages ESG strategies or is accountable for ESG strategies ought to display certain characteristics:

- A strategic mindset

- Ongoing daily board presence

- A conduit of multiple strategies across global organisations that are knitted together into a value set.

The COO is in a unique position to manage transformation and co-ordinate ESG strategies.

Trends

Since the pandemic, more organisations are signing off on sustainability initiatives as they are considered a tool for businesses to manage their long-term risks, operations and to navigate uncertainty. In parallel to this, there is greater demand for transparency and accountability. Furthermore, many organisations are concerned they may disclose too much, and be exposed to allegations of greenwashing.

“ESG has become an integral part of most financial institutions strategy, and ESG commitment is expected to be owned not only by the COO community but also by the business side and partners.”

Jeff Rosen, Managing Director & COO, Americas Global Markets at Societe Generale

UN Global Compact Signatories

17,000 companies from 160 countries are committed to the UN Global Compact’s 10 principles. The 10 principles are considered a way to define ESG.

Challenges to the signatories of the UN Global Compact

- Inflation

- Talent scarcity

- Threats to public health

- Climate change

- Trade regulation

Science Based Targets initiative (SBTi)

SBTi is the leading standard setter and certification body for corporate climate action. In 2022, they validated more targets than in the previous six years combined. 4715 companies have made a commitment to climate action through the SBTi.

The supply chain remains a challenge across all industry sectors.

SBTi’s target is to reach a third of the global economy by 2025. This reflects $20 trillion of the global economy, 5 gigatons of corporate emissions and 10,000 companies worldwide. Large companies, the oil and gas sector and SMEs are all being targeted for systemic transformation.

View the companies committed to the SBTi here.

Financial services sector

Banks are assessed in terms of their investment and lending activities and the engagement they have with the companies they invest in.

The UN is asking for transition plans to indicate the credibility of the targets announced, outlining how targets are going to be met, the level of investment, where the investment is coming from, and which technologies are going to be used.

Reference Link: Is 1.5S still realistic? The crumbling consensus over key climate target, Attracta Mooney, Financial Times

Regional activity – North America

The SEC has proposed rules that would require publicly listed companies to disclose their climate risks and the risks that climate change poses to their financial returns.

The Inflation Reduction Act is also a major shift for the US market. Major federal contractors are required to publicly disclose their climate-related financial risks and to set science-based targets, making the US the first national government to require suppliers to set Paris Agreement aligned reduction targets.

Panel Q&A

How to reach a tipping point on business engagement around climate change?

The war in Ukraine and the resulting disturbance to the energy supply chain contextualises the ESG discussion, particularly when referring to investment in energy transition. Greenwashing has become an increasingly significant concept, as it brings an enhanced level of scrutiny from regulators and stakeholders to the targets set by banks. It must then be down to the COO to drive the ESG strategy forward.

The extension of this scrutiny to encompass businesses within a parent company’s supply chain is pushing firms toward a tipping point where they have nowhere to hide as they disclose this carbon emissions data, and they must look carefully at who they do business with to avoid damage to their reputation.

What efforts do you see being made in the financial industry to define the implementation strategy?

Banks must reduce the carbon intensity of their own balance sheet. The challenge is relying on suppliers’ own reporting on their emissions. Financial institutions must be able to implement their commitments. There must also be collaboration between a bank and its clients and suppliers to assess their impact on the bank.

What is the role of the COO in institutionalising ESG considerations?

The first step is understanding the business, and what their organisation is being asked to report on. Then, organisations can think about ESG through the lens of their business. Within this process, the COO must openly support ESG initiatives.

The next step is designing a roadmap. Each organisation must look and its peers, and what is important to their company. This breeds a culture of competition which drives executives forward in institutionalising their ESG considerations.

The COO must also assess whether the appropriate functions exist to support the institutionalisation of ESG considerations, and whether they have the necessary tools required to do so.

COOs are in a unique position of truly understanding how to bring the organisation forward.

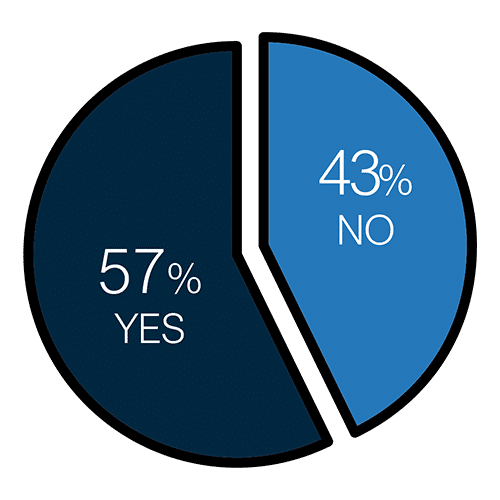

Audience Participation: Do you think your organisation will reach the net-zero target by 2050?

Key elements of the net-zero target: Companies must reduce emissions by 45% by 2030 (near-term SBTi). By 2050, carbon emissions must be reduced by 90% and 10% can be compensated through offsets or removals, for example.

As a COO, how do you embed the identification of emerging risks in the day-to-day risk management and change the culture of your organisation?

Scanning of emerging risks is a key part of the COO function. Understanding the rapidly changing global regulatory landscape is also key.

The best way to understanding ESG risks is data – analysing data, verifying data, and using data to drive your risk programme.

There is also large variance within ESG risks (e.g. geographical) which must be understood to put the right management structures into an organisation which can be aligned with existing enterprise risk management.

Regulatory pressure will also be a key driver in embedding ESG into day-to-day risk management.

What regulations are coming out of Europe in relation to ESG?

- Sustainable Finance disclosure regulation: allocation of funds into three articles depending on what the companies are, and report on the principal adverse indicators.

- TCFD: putting a framework in place around your climate disclosure.

- Corporate sustainability reporting directive

- Corporate sustainability due diligence [in relation to your supply chain]

What does an ESG champion look like?

An ESG champion must be comfortable with ambiguity. The ESG champion must combine this with a data-driven background and regulatory expertise. They must also be comfortable in educating and influencing others. ESG is also about collaboration and communication, as it must run through the organisation in its entirety.

How does the COO engage with the third line of defence on ESG?

There must be a constructive and patient approach to relationship, as ESG strategies are a work in progress. It is a collaborative effort, and it is principle-based not metric-based. Material topics should be picked out of the overall ESG strategy (which cannot be audited), which can be covered at different times.

Is the implementation of ESG strategies a useful tool in retaining staff and acquiring new talent?

A commitment to ESG is particularly attractive to the younger workforce. ESG also has a higher representation of female talent at all levels than other areas of the organisation. It can serve as a springboard to address diversity in other areas of the business. The converse is also true, and poor commitment to or execution of ESG strategies can lead to high levels of attrition and poor workplace culture.

The structuring of sustainable finance products takes time and requires many different teams to come together. The engagement from these teams is higher than on other projects as staff are being mobilised for a common purpose.

How can we strengthen the case for ESG to disinterested parties?

- Finding common ground in the business case

- Practical steps e.g., energy efficiency

- Commercial case (saving money on the bottom line)

- Outlining how ESG contributes to reducing risk and increasing operational resilience

- Positioning ESG as a risk object by asking how companies will be impacted by environmental, social and governance changes

What data is needed to help build an ESG strategy?

What can be measured can be managed. The priority is to define what has to be measured. Once that objective is defined, the subsequent acquisition of data can be structured around that goal..

Data can be prioritised and categorised. Once the priorities are accounted for, draw out a roadmap for the other data sources wanted.

The control over your organisation’s own data narrative is important to avoid investors making decisions based on comparable assumptions with your peers.

In private equity, the ESG Data Convergence project exists which has narrowed ESG metrics down to six key data points: green house gas emissions, renewable energy, diversity, work-related accidents, net new hires and employee engagement.

“A very rich and engaging discussion fuelled by a UN representative giving an inspiring speech reminding the audience of the UN commitment made to the progression of ESG and those initiatives created within the financial services industry. While the financial sector is still exploring the best organisation to support ESG efforts, COOs, as key players in transformation topics, are and must remain at the centre of the discussions.

Noemie Chantier, Head of COO Equities & Derivatives – Americas at Societe Generale

Breakout Room with Entelligent:

How consultants can help COOs to manage the ESG transition

Sustainability risk is business risk

- Supply Chain Disruptions

- Legal and Regulatory Fines

- Reputational Damage

- Increased Operating Costs

- Investor Risk

This generation of COOs has a responsibility to build their firms into sustainable and resilient businesses by managing the complexity of supply chains, as well as regulatory and investor pressures, operations, consumer demands, technology and data ecosystems with the right prioritisation and attention to global risks.

The state of play

- Frequently, dubious self-reporting on ESG leads to a data gap.

- Most companies adopt decarbonisation and undercut diversification which is a key pillar of risk management.

- They also assess their impact on climate, rather than the climate’s impact on their company.

Sustainability/Climate Scenario Analysis

- Measures the impact of climate change and energy transition on business operations, supply chain, markets and product plans.

- Provides data standards through back- and forward testing, identifying and assessing future risks, and developing appropriate risk management strategies.

- Allows engagement with stakeholders, such as investors, customers, and employees, on climate-related issues.

- Sustainability/ climate scenario analysis can guide strategic planning to develop a more resilient and sustainable business strategy.

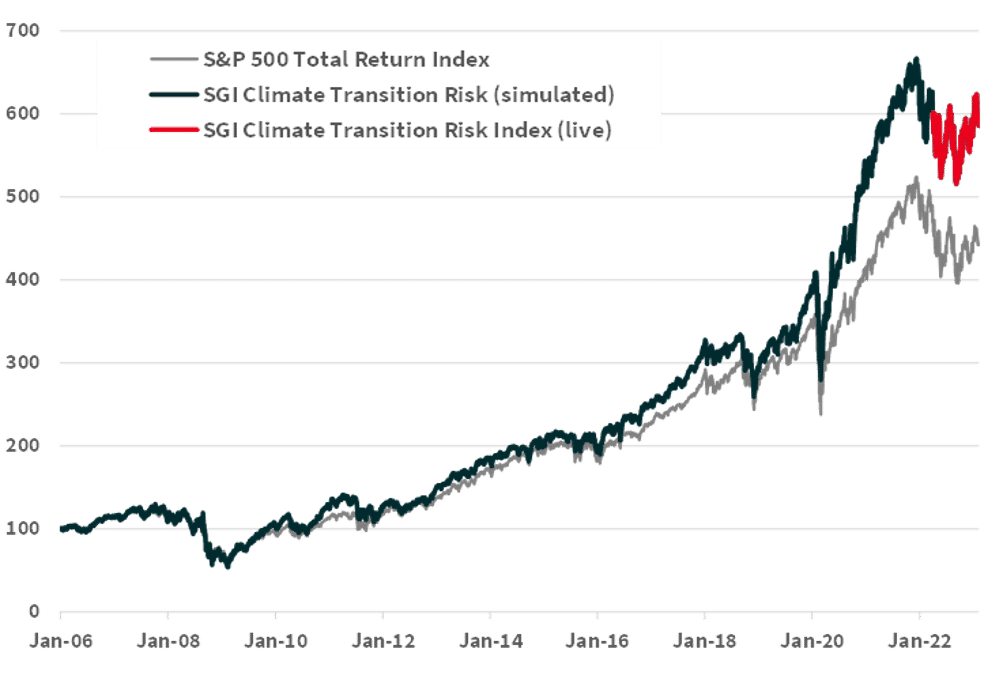

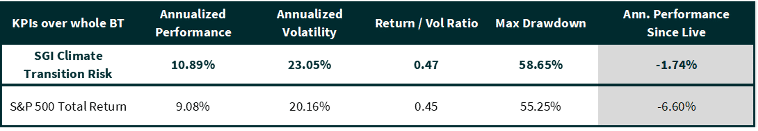

Equity Outperformance

Hypothetical performance vs. S&P 500 total return.

Long-Term performance

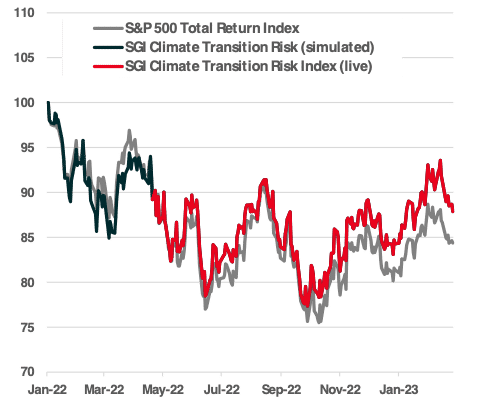

Performance since January 2022

Breakout Room with Control Risks:

Managing ESG risks and building strategies for a volatile world

Top 3 ESG issues in 2023 for businesses

1. Energy Transition & Industrial Policy

- The war in Ukraine has accelerated the energy transition in Europe.

- The Inflation Reduction Act has accelerated the energy transition in the US.

2. Supply Chain Due Diligence

- Secure and resilience supply chains have become much more of a priority globally.

- Legal and legislative focus on forced labour.

3. Geopolitics

Geopolitics makes corporate governance more complex due to pressure from shareholders and stakeholders.

ESG implementation

Top 3 mistakes organisations make when implementing ESG strategy:

- Not fully integrating ESG into business strategy.

- Not focusing on material issues and what is important to each organisation.

- Lack of transparency and stakeholder engagement (greenwashing).

References

Source: Bloomberg, SG Financial Engineering and Entelligent from 1/24/2006 to 2/28/2023. All results are calculated for periods ending as the date above. The historical performance information set forth herein is illustrative and provided for informational purposes only. It should not be read as a guarantee or an indication of the future performance of the Index described herein or any other Index.

The SGI Climate Transition Risk was launched on 4/22/2022. Therefore, all data for the Index prior to such date represent the application by the Index Calculation Agent and/or the Index Sponsor of the Index methodology in order to reconstruct hypothetical historical data. Some or all of the hypothetical historical performance data presented herein may not have been verified by an independent third party.

Name at least one way in which your organisation is participating in the decarbonisation effort:

- Offsets

- Work from home

- Less Travel

- Changing business model

- Participating in voluntary carbon markets; making sure that this is a board priority

- Funding renewable projects

- Engaging with high emitting lenders

- Energy efficiency

- Travel focused deals

- Support client on the decarbonisation effort

- Advising clients on transition

- Not printing meeting materials

- We purchase offsets and are carbon neutral in

Scope 1 and 2 - Helping our clients write their transition plans and think through reaching net zero goals

- We help portfolio managers understand the impact of the transitioning economy on their portfolio

- Investing in energy transition

- Commitment to net zero aligned to 1.5 degree pathway across managed portfolio and operations.

- Reduce single usage plastics

- Zoom subsidising EVs

- Saying no to unnecessary travel to head office for conferences

- Travel cut backs. Air travel cannot be done under certain mileage

- Switching energy to renewable in Japan for our offices

- Targeted funding

- Supplier codes

- Plant trees

- Adopting a coal policy

- Systematically reducing exposure to carbon-intensive industries

- Offering discounts on fees for counterparties with decarbonisation plans

- Green energy

- More walking/biking

- Review of data centre(s) energy & efficiency

- We only use cans in our soda machine and no plastic. Cans are cheaper to recycle and carbon friendly

Who is accountable for ESG strategies in your organisation?

- Head of strategy

- ‘The board’ but not an individual director

- Product heads with the help of in-house strategy team and consultants

- Department Heads

- Group/Head Office has identified a person/group. However, there is a lack of clear direction and the inability to measure at this time

- ESG Committee

- It is currently centralised in Head Office with specific work streams in the US on specific elements of ESG

How would rate your organisation’s maturity in its ESG Strategy?

How confident do you feel your ESG strategy is, in front of an ESG expert?

Other articles in this edition