“What is the role … your role as a markets’ COO?”

THE MARKETS’ COO

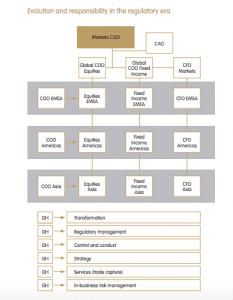

Evolution and responsibility in the regulatory era

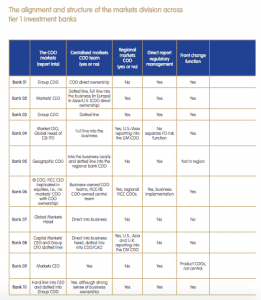

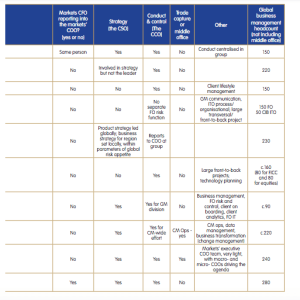

Organisational alignment

In a round table discussion, it became quickly apparent that while those present were the same in title, each role differed greatly. Organisational alignment varied from the fully integrated model – with the group COO ‘owning’ the markets’ COO and the markets’ team globally, even component parts of the infrastructure – to the fully decentralised model. Here, the markets’ COO reported to the markets’ CEO, but did not ‘directly own’ the business management function and the product COOs below them. Whatever the alignment, however, it was clear that the governance structure in place impacted cross-functional and non-product-aligned activities, such as control and change.

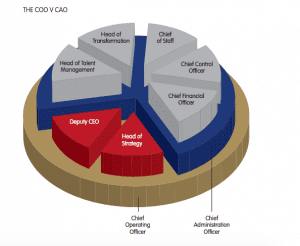

The table overleaf shows the alignment of the key component parts within the markets’ front-office business management function at the highest level. Observations drawn from this are as follows:

• The majority of markets’ COOs report directly to the markets’ CEO, with no report line into a group COO. With the regional nature of regulatory change, banks are increasingly appointing regional markets’ COOs (EMEA out of London, Americas out of New York, Asia out of Singapore or Hong Kong). External strategy is usually a chief strategy officer appointment into the CEO; internal strategy is usually married to ‘change’ and the provision of business solutions, being a report into the markets’ COO.

• To address the burden of regulatory change and the consequent implications of the control agenda (1LOD), more than half of banks have appointed a divisional control officer (Chief Control Officer, CCO). This person invariably comes from a fixed-income business management background.

• A quarter of those appointed at CCO have a dotted or full line into a group CCO and the remainder into the markets’ COO.

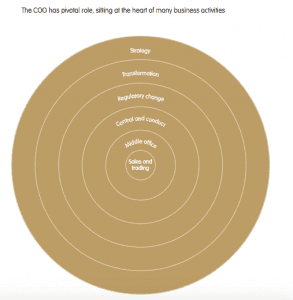

Conduct is split between conduct risk, within risk management, and a conduct lead, sitting in the CCO’s office. Very few banks have not appointed a markets’ conduct lead. Increasingly, the middle-office and trade-capture functions are migrating into the front-office business management function.

There are several reasons why the COO role has struggled to fully cement itself within today’s C-suite. Some companies may opt to split operations responsibilities between several executives. In others, the CEO may decide to handle operational issues directly. However, in many companies, across a range of industries and regions, changing market dynamics now offer a chance to clarify the inherent logic of the COO’s role – at least for those willing to take on the challenge.

Some or even much of the above may be relevant to markets within banking, but the mandate, tasks and accountability of the COO have become far more precise, and success or failure is reflected significantly in reward. The markets’ COO sits over a suite of businesses (across fixed income and equities), each with its own global and regional nuances, and each business at global and regional level also has its own COO. Not surprisingly, the challenge of being a global markets’ COO overseeing many businesses under one umbrella has its complexities. It is the unique ability to be charged with managing a number of COOs (some directly, some indirectly) while handling the reigns of collective accountability that sets the role apart. A markets’ COO has to be adept at managing resources both directly and indirectly. This is often difficult when facing strength of character and a sense of individual purpose in a counterpart during the decision-making process.

Concentric circles of responsibility

New business dynamics redefining an old role

The following factors underscore the need for a strong leader, with operational orientation experience, especially within the increasingly complex business environment of global banking:

• A daunting regulatory environment.

• A tougher emphasis on efficiency and cost management, including a drive to transform many core aspects of the business.

• The need to seek out, validate and expand into new products and markets in the pursuit of growth.

These needs are also highlighted by the increasing speed of change, from ever-shorter product development life cycles to a continuously evolving technology. The effects of this are clearly felt by today’s COOs. As Ernst & Young LLP’s report, The DNA of the COO; Resetting the logic of the COO’s role outlines:

“One in three of those polled says that increased complexity and a wider set of tasks have been the most striking change in their job over the past five years.”

Summary of changed tasks for a COO (2010–15)

When asked, the COOs in place now, reconciling the demands of the role up to five years ago, make note of the following:

• Increasing complexity of the regulatory environment.

• Increasing pressure on efficiencies.

• Growing importance of the strategic and future operating model. • Being up to date with technology trends.

• Increasing risk and compliance issues.

• Improving the management structure and communication from the board throughout the business, front to back.

• Growing importance of process management and standardised/best practises.

• Increased demand on demonstrating management competencies. The common threads running through the eight points above are control and cost, but there is also accountability to deliver this control and drive change to deliver the cost savings. COOs are being asked to do more and to do better with less, in the pursuit not just of competitive advantage, but as one COO stated:

“… To stay operational, to stay alive, to be one of the few left standing as we try to marry falling revenues with the cost demands of implementing regulatory change”.

Change brings opportunity

It is not all bad news, as there will still be a banking sector after the regulatory era. It will be different, certainly – reshaped, likely better managed and more highly regulated – but there will be a new platform for the next generation to innovate and deliver new services and products within the confines of the new world. For ambitious COOs, all this provides a significant opportunity. More than any other executive, COOs are well placed to take on such challenges and cement their position within the organisation.

Furthermore, the CEOs of today should understand that throughout this change, they cannot successfully operate, and will not deliver on investors’ and clients’ expectations, without a COO of the highest calibre. Not least, the COO is there to ensure that the CEO, carrying collective responsibility for the business, remains this side of the prison bars. This fact alone has been enough for most banking CEOs and business heads to choose their right-hand man or woman very carefully. Hiring the right COO can also free up the CEO to focus on setting the corporate vision and goals, while then relying on the operational leader, the COO, to shape and implement the underlying strategy. In some banks, this also acts as a form of succession planning, as future business leaders migrate through the role of COO, shaping them into a more rounded and relevant business head.

Adapting to the environment

Unlike other management roles, such as the CFO, there are no professional standards for the COO, nor are expectations of the job common across all organisations. Rather than possessing a single set of skills that can be easily identified in any business, COOs have to adapt, chameleon-like, to the environment in which they find themselves. A common call of COOs is, ‘It is up to us to prove that we’re bringing added value. We need to do a better job of marketing ourselves.’ COOs will greatly increase their chances of success in the role if they can demonstrate clearly to other members of the C-suite the value that they bring.

Important, but not indispensable?

In general, markets’ COO C-suite peers have great respect for the demands of the role. Yet, when it comes to the question of whether a company would perform worse if it had no COO, opinions differ, especially at a level or two down in the infrastructure. The real value of an in-business COO is known only by the head of the business/the CEO or those in close proximity to the COO.

COOs need to work more at self-promotion and communication in order to raise the value-add profile of the role. This is not about self-justification, but rather an effort to foster a greater understanding of the role and influence of the COO across the bank – to the benefit of all. For the CEO, the COO is both the lubricant keeping the wheels of the business turning and the glue keeping all working parts together. This dual role is sometimes misunderstood or not understood at all.

Areas where a COO’s work adds value to a company

In the same way that CEOs and business founders require entrepreneurial skills to devise new business ideas and create a culture of product and service innovation, the COO must also be entrepreneurial. Besides taking responsibility for the diverse day-to-day operational demands, COOs in many banks handle larger business-transformation initiatives and have started to drive strategy. A mastery of change management is therefore a core part of the role for many and perhaps even how the position was secured in the first place. The willingness to embrace change requires COOs to be comfortable making decisions.

In general, COOs seem to be measured on the following criteria:

• Increasing efficiency within business operations.

• Keeping to the budget and meeting investor demands. •

Realising cost savings (and realising future business benefit).

• Performance and agility of the business management and supporting operational functions.

• Leadership skills and engendering a culture of loyalty performance and innovation.

• Improving the company’s financial metrics and governance.

• Improving company’s ethical standing, especially in relation to control and the regulatory agenda.

• Strategic planning and the mindset of the overall leadership team.

• Ability to attract, hire, train and retain talented people.

The new go-to person for bank wide transformational initiatives

When asked, a high percentage of markets’ COOs stated that they were closely engaged in discussing the role that operations and the infrastructure could play in business transformation and changing the future state of the business. A higher percentage, however, believed they should spend more time and have more input in helping to structure wholesale change within the bank, possibly moving the ownership of operations and technology directly under the business. This in itself is a return to the beginning of time, when the COO did indeed own everything behind the trade, its findings drawn from a COO forum that proposed the question, “How does the COO community reshape the conversation with operations and technology?”

Talent management

The COO has the chance to take responsibility for an initiative, which could turn it from being a decision based upon a wholly operational perspective to a more strategic one. It also offers the opportunity for the markets’ COO fraternity to cooperate to change the state of banking in ways that previous market-wide efforts (Swift, CLS, Swapwire and others) have not allowed.

In such a hypothetical position, the COO would control the allocation and prioritisation of corporate resources and assets to achieve the strategic goals. Once a decision has been made, the COO must ensure that the right resources are in the right places. There is thus a strong link between this aspect of the role and people development. As with all aspects of their role – past, present and increasingly the future – COOs must be deeply involved in talent management.

Joining the strategic inner circle

COOs may need not only to master operational excellence, but also to become a driver of strategy. This switch in focus highlights a dichotomy in the role of the COO today. On the one hand, COOs must focus their attention on the here and now. This demands a deep involvement in operations to ensure that they are performing at optimal level company-wide. On the other hand, they must find the space to shape longer-term strategy, because they are best placed to assess the extent to which they actively engage with the board on key issues:

• Discussing business performance and decision-making.

• Driving operational innovation by embracing technologies.

• Driving operational transformation and direction front to back.

• Realising operational efficiencies and standardisation.

Thriving on challenges, rising above complexity, here now the markets’ COO

The main challenge for COOs is carving out the space to showcase their skills. It requires them to find a ladder out of the operational trenches, to gain a wider perspective of the business. But such challenges are what COOs thrive on. When asked what makes their role worthwhile, respondents point to the fact that it brings fresh challenges every day. They also enjoy engaging with a wide variety of different functions and departments across the business.

Markets’ COOs need to challenge the common perception that the role is primarily concerned with keeping the wheels turning and little else, dealing with and executing the regulatory agenda, meeting the demands of the business from day to day. To overcome this, they must demonstrate that they make a strategic contribution to the business and that their role ‘moves the needle’ on business performance. They must show they can, if required, run the business, regardless of the fact that many of them lack experience in managing risk.

Some say that COOs need to capitalise on their unique vantage point and now is the time to do this. How? By getting involved in almost every function, COOs can spot interdependencies and help integrate activities across the business. They can break down functional and geographical silos and identify ways of combining assets to drive efficiencies and transfer best practise.

The markets’ COO may carry different responsibilities bank to bank, and the weighting of these responsibilities may vary, but they do carry the heavy burden of collectively shaping key component parts of the banking industry. This can be achieved by working with internal leadership as well as with peers industry-wide.

“It would be difficult to classify my role in one of the seven boxes. It was an amalgamation of all those roles. As COO, my responsibilities were to run a successful business and to help the CEO of the business achieve his or her goals. On occasion, successful traders or salespeople were thrust onto management roles with no real business experience. This would be similar to asking a baseball player to run Major League Baseball after a successful season hitting or pitching. In these situations, a COO would need to guide a head trader or salesperson on how to run a business. Sometimes the new head would have no interest in learning the details of the business and would implicitly have the COO to run the day to day”.

FORMER GLOBAL COO, INSTITUTIONAL SALES