“A view through the lens of commerciality and objectivity is a key attribute that the front-office business manager could bring to the role of head of operations.”

SKILL SET MIGRATION FOR THE COO

Target operating models within global operations

The need for commercial leadership and functional objectivity – step in the COO.

With evolution and with the demands of cost and control forced rapidly into an uncomfortable marriage, the profile of the operations head has had to change in response to these dynamics. Commerciality and an ability to look through a different lens to deliver entrepreneurial solutions are recognised requirements of such an executive post. Outsourcing and/or relocation partnering to in-house or external piecemeal technology solutions and improvements will no longer meet the demand for either wholesale change or the savings required for individual banks and the industry as a whole to achieve sustainability. The current model and its trajectory will simply not deliver the required cost reductions over the long term.

Into this space steps the front-office business manager – the COO. An increasing number of banks have appointed a head of operations from within the business, but such appointments have raised eyebrows. Surely this person cannot understand the intricacies of the operational processes and lacks the management experience necessary for overseeing a global function?

This may be true, but what they do understand – the accomplished ones – is a need to look beyond the present, limited, operational horizon and question the viability of the current business plan. They will then seek to design and execute a new vision – one not tied to any legacy strategy and with no emotional attachment to the historic need for the business to build, invest in, buy in and own its front-to-back operational processes.

A view through the lens of commerciality and objectivity is a key attribute that the front-office business manager could bring to the role of head of operations or principal middle-office head. Equally important are the decision-making criteria of the appointee, as he or she will have to understand and embrace the imperative of such an appointment, moving swiftly past the emotional matter of shifting from an executive role in the front office to one in the back. Once focused on the mission of the role, which will lead to a better business model and sustainable profitability, the decision should be an easy one. By prioritising pragmatism over ideology, it should become apparent to the more enlightened that this is an opportunity for making a real difference. Mid- to long-term career opportunities will not be in short supply for those who deliver in such a role.

Target operating models within global operations and opportunities in leadership for the front-office business manager

Leading change from front to back

While many COOs venture down their career paths with a sense of shrinking opportunity, some have taken advantage of this evolutionary moment to move from front-office roles into those of principal leadership within operations. The accountability of control front to back and the demands to reduce costs are now the leading items on most agendas. Thus, as businesses seek to align themselves ever closer to the infrastructure, transferring experience and patronage from within the business into a role supporting it has become increasingly commonplace. So, what enables this talent to be successful in such a different role?

Background organisational analysis

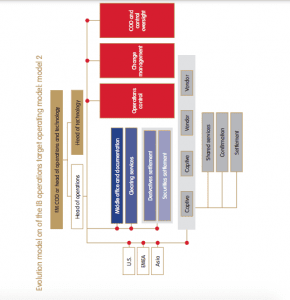

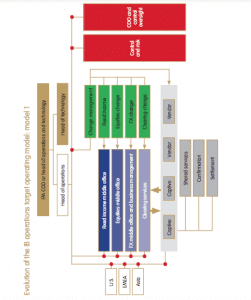

The following organisational charts give examples of the operational process and leadership alignment in principal financial market franchises. The interpretation of these alignments has been gathered from those currently or previously in operations leadership positions; while they are not wholly accurate, therefore, they are representative. They show that while no two banks have exactly the same structure and organisation, there are themes that run through the market:

• The continual move towards the use of utilities and investment in near-shore capabilities to support more sensitive products and/or to mitigate the effects of compensation increases (and therefore loss in savings) at maturing low-cost centres, such as in India, due to increased competition for experienced talent.

• The integration of cross-sector operations processes, such as financial markets, wealth, private banking and asset management (although, having spent millions on this horizontal functionalisation, some banks are now dismantling it).

• The evolution of the middle-office manager as the ‘new executive’ of operations and/or the movement of middle office into front office, reporting to the front-office COO.

• The establishment of clearing and collateral business support groups (independent from fixed income and/or equity operations)

• The role of the operations COO (or other) as the/a global control officer responsible for governance, control and transformation (within operations and/or technology).

Research shows that head of (markets/IB) operations is a standalone mandate reporting to a head of operations and technology and/or to the COO when in a divisional construct at markets/IB level. However, when in an integrated, cross-divisional alignment, the head of operations may report into a divisional CIO or into a group head of operations and/or group COO. There appears to be no consistent target operating model, and in many cases the model itself has changed multiple times within a bank, as leadership struggles to meet the varied demands of cost, efficiency and regulation.

Additional observations

While the Investment Banking Operations executive and leadership teams are charged with delivering common services to the sales and trading business, how they are aligned varies significantly between the leading financial market and/or capital market franchises. The exact alignment may vary for several reasons, including:

• Regional bias of the business.

• Business weighting across fixed income and equities.

• Maturity of the infrastructure.

• Key personalities and organisational preferences.

• Corporate commitment to off/near shoring (captive or vendor). Armstrong Wolfe’s research into the present alignment of operations outlines a relatively uniform progression across the market in the evolution of the target operating model:

Phase 1: Fixed income and equities operational product heads (including front to back from middle office, through confirmation into settlement); global heads of shared services/control, change management and cross-product regional heads of operations.

Phase 2: Global heads of derivatives and securities operations; global heads of shared services, change management and crossproduct regional heads of operations and appointment of a global control officer (as COO or other).

Phase 3: As above, with the migration of core operations headcount to low-cost centres (off- or onshore) and, more recently, outsourcing.

Phase 4: (Present state) evolution of the middle-office function as global product heads (be they a ‘fixed income – equities’ or ‘derivatives – securities’ model), with mature hub locations for core processes, single domain/product change functions, with a separation of clearing and collateral management.

Phase 5: Where now? Reduced revenues and the impact of regulation have led to an increasingly common and shared view that a seismic shift is needed within the industry if a sustainable model and acceptable cost ratio (for operations and technology) is to be achieved. Challenging the status quo, looking beyond banking for solutions and new technologies, and cross-industry collaboration will all be needed to meet this shared objective. How to mobilise an industry, specifically this industry, to produce a common and shared solution is perhaps the greatest challenge of all.

Moving parts: the middle office is moving forward

Aligned to the changing emphasis of the middle-office role, the middle office – or component parts of it – have been moved to front office, to report to the front-office COO. This is driven in no small part by control and the need to bring this key area of process (and people) risk closer to the front end.

Most banks have reviewed, evaluated and in some cases executed this organisational change, moving this operational process into front office. Present market challenges around cost management, regulation, control and clearing are impacting the present and future alignment and the target operating models of investment banking operations functions. Banks have addressed these challenges in different ways, some of which are outlined below.

Cost management vs risk and control

To varying degrees, banks have embraced the low-cost centre model, where the benefit of migrating headcount to low-cost centres is unquestionable. Whether this is on- or offshoring, or vendor or captive utilities, a variant of this operational strategy is now in place in all banks. Strategies on such initiatives vary significantly, from corporate and group strategies and rigid adherence, through to alignments at divisional level and, in some cases, those influenced by executive preferences and personalities.

Central to the decision-making process are the savings to be realised, weighed against the level of acceptable risk within this headcount migration. More recently control – and implications of failures in control – have played a role in defining this strategy within the first line, just as the implications of regulatory change are doing so downstream and into operations, such as Dodd-Frank and clearing demands, and defined requirements on the front to back business proposition and processes. This has provided support for some of the more complex operational processes to be brought back onshore. It has also provided confirmation for those that have not yet moved that they will remain where they are.

Cost savings vs risk mitigation

How these demands are to be accommodated with the low-cost and/ or outsourcing strategies in most banks is not yet clear, as internal debate continues on these extenuating factors. Entering 2016, the markets were cornered by compressed revenues, plateauing costs and enhanced regulation. The default position within operations and technology was to realise cost savings relatively quickly through offshoring and/or outsourcing. However, this endgame strategy is now being questioned, and it is generally recognised that a longerterm and more commercial solution is needed.

In this context, those holding fast to quantified savings find themselves in debate with the subjective and qualitative view as to the overall benefit. Why? Firstly, the level of enhanced operational risk and loss of control incurred from the aggressive pursuit of a low-cost centre strategy is often cited as a counterbalance to pure price and cost effectiveness. Secondly, it reduces the cost to a certain level, and is better than the present situation, but is not the end solution.

In some cases, banks have responded to the risk and control issue by establishing onshore locations to service some of the more complex processes, although at a higher cost than if they were based in India or Manila, for example. The argument for this is that the increased comparative cost is justified when taking into consideration the enhanced risk involved in supporting certain businesses and products. In this case the issue over legacy and the ongoing cost remains.

Not surprisingly, with so many banks struggling to maintain margin and profit, the pressure on cost is pushing the debate to the forefront of discussion between the business and operations:

“Exactly what part of my operational service do you want me to stop or exactly what level of enhanced operational risk are you willing to accept if I have to (a) move headcount (b) remove head count?”

This statement (or a variant of it) is one that many operations executives would have used during discussions about ways of driving down costs, concerned as they are about the enhanced levels of risk involved in this period of sustained change and aggressive cost management and reduction. This is even more relevant as accountability for control failures is often more readily (and rightly) allocated to departmental managers.

Control and cost: an unhappy marriage

The debate is not about empire building or parochial desires to hold on to headcount, but is rather about exactly what is right for the business during this phase of market change. What we have gathered from market interaction is that while core operational processes – be they simple or mature – are well placed to be moved into low-cost centres, not all processes that are theoretically capable of being moved into low-cost centres should be subject to that move.

The focus of the debate tends to be ‘where or what next?’, with banks looking into previously untouched areas/processes to find savings, moving processes from principal business centres into utilities. This is especially apparent in middle office and an assessment of risk and front-office components. However, it is still somewhat short of the leap required to revolutionise the way the banking industry supports its sales and trading activity.

Time for fundamental change: the art of the possible?

The industry must change because the present operating model is not sustainable. This statement captures the essence of conversations being held industry-wide. It has long been recognised that the present cost burden of a bloated, overpaid infrastructure (headcount mainly within operations and technology) is unsustainable. Strong revenues had once been able to carry it, but this is no longer the case, and banks are being forced to look internally and aggressively at their operating models. The more enlightened are also looking externally and to the art of the possible. There are many examples of cross-bank and cross-industry cooperation, demonstrating collaboration in establishing centralised operational services. SWIFT is testament to this, as was the market need for CLS. This does, however, still tinker with the main issue, where “creation of a bank-wide, industry-wide, industry-owned settlement utility would be nirvana”, as one COO has suggested.

Is this possible? Of course it is – the technology exists. The issue is whether the courage and willingness at individual banks also exist. It appears that the simple economic imperative to make such a leap may force the hands of the sceptics.