“The challenge when making any organisational changes is convincing business heads that it is not taking away their right-hand man/woman, restricting the bespoke nature of this key supporting asset, but is rather making this role more effective for both the business heads and the business as a whole.”

NEW HORIZONS AND TROUBLED WATERS

A quantification of value

New horizons and a higher threshold for performance frames the future of business management, as CEOs seek quantification of value and COOs feel the squeeze of accountability.

CEOs drive organisational change

Increasing regulatory demands, cost containment/management, a focus on maintaining and sustaining profitability while seeking growth through hard work and innovation, all within a distressed market where every bank is struggling to maintain market share within a shrinking market … these are the embedded dynamics being managed by today’s leaders of the banking industry. When such pressures are combined with the challenges of securing and retaining the best people to deliver success, today’s CEOs and business heads claim commercial leadership is far more difficult and diverse than in the past. In addition, the levels of regulated accountability for this leadership are distinct and far from those that went before them:

“Business leadership in 2016 is somewhat a distant cousin to that of pre-2008. To achieve my objectives I need a different tool kit, different people possessing a different mentality. One of the cornerstones of successful executive management in banking, in my opinion, is in defining the role of the COO (front office) in the modern context, then selecting the right person to undertake this role (and not compromising in this selection) and working with my COO to make him or her effective. My COO and I must make one, my shortcomings made good by his or hers. In making the right decision, in ensuring the role is defined, this will make me more productive, enhance my performance, ability to focus on revenues and strategy and, most importantly, business delivery”.

This summarised quote from a leading investment banker represents a very modern interpretation of the role and importance of the COO (for which, read business manager, chief of staff, front office CAO). It somewhat counters the traditional view of the ‘business manager’, who, in some cases:

“… appears to spend the majority of his or her time duplicating the work already undertaken by other departments for no other reason than to ensure the well-constructed and detailed reports delivered from elsewhere are actually reliable”.

This role appears to have evolved in part because of the mistrust that can exist between departments (specifically the business and some of its support functions) and their consequent inability to work effectively together. However, our research clearly demonstrates that what historically has been a ‘nice to have’ has now become a role of great impact, influence and necessity. This is particularly true in an era when COOs increasingly find themselves at the heart of the regulatory agenda.

In some cases, company-dependent quantification of value is now being sought for the business management function, bringing the value of individual COOs under equal scrutiny:

“My global COO function in reward alone cost me somewhere in the region of £50 million in 2015 – this before any control allocated headcount is taken into account. It is my responsibility to understand how this investment is being spent, what the function does and to ensure that the firm gets £50 million of value from this investment. We are some way from this point, but uniformity, transparency and consistency in mandate and indeed reward will enable me to do this more effectively”.

HEAD OF PRODUCT CONTROL, GLOBAL INVESTMENT BANK

The challenge when making any organisational changes is convincing business heads that it is not taking away their righthand man/woman, restricting the bespoke nature of this key supporting asset, but is rather making this role more effective for both the business heads and the business as a whole.

The role, its mandate and its perception vary significantly from bank to bank and, in many companies, from one business line to another. There now exists a market-wide recognition that a different level of executive is needed in these roles today, which brings a requirement to hire upper-quartile talent into these roles and to carry the cost associated with rising reward for key players within the COO market. This in itself shines a spotlight on the role and the broader business management function.

Talent does not come cheap in a sector where the pool is relatively small and where those who have successfully adjusted to the increasing demands on the COO (be they regulatory, control or risk responsibilities) are even more rare. There is a significant difference between a ‘run-the-business’ COO – at any level – and one who has a proven track record of driving change to help business growth and/or performance. Importantly, while the core behavioural and technical competencies may be defined, a suitable personality fit with the business head is essential. When this qualitative component comes into play, selection and retention of the best COOs can be very difficult.

Market dynamics and the challenge for the COO can therefore be summarised as follows:

• Continued pressures across the industry and evolving demands on business heads have manifested themselves in a change within the accountability, visibility and demands on the business management function. • This dynamic function is having to respond quickly to the change and while many would argue that they are being paid less for doing more and carrying increased accountability, the upside is that the role is now more valued (and perhaps understood) and varied than ever before.

Key areas of common and market-wide consideration – and what is resident in the COO’s in-tray – are outlined below, along with historic reward and compensation. The latter, however, has significant variables, and even the best analysis is not wholly reliable due to the differences from bank to bank and role to role.

Key dynamics within the COO community

1 Review of the organisational design of the business management function with, for example, a number of banks having moved some operational components into front office (e.g., trade capture), with many banks at group level also citing headcount growth within the business management function as a growing concern and in need of review and validation.

2 The feasibility of the merger of the COO and business management functions at group and divisional level (at divisional level, for example within IB/markets, the integration of sales and trading within business management).

3 Organisational review of the 1LOD programme and allocation of headcount to the control and conduct effort and the interrelationship and ownership of tasks with operational Risk/2LOD.

4 How is change managed? The centralised approaches are being scrutinised at many banks, with an additional focus on the development of low-cost centres, on- or offshore for front-office headcount.

5 Dealing with industry-wide change and, in particular, the impact on fixed-income markets and how all banks, to one degree or another, are restructuring their fixed-income divisions.

6 Title review, with many in the market understanding that the title of COO has been diluted and lost its equity and brand value in recent years, recognising that many (or even most) COOs are in fact by task a CAO or business manager. Some banks have already removed the title of COO in many instances to reinforce the mandate and seniority of the COO title itself.

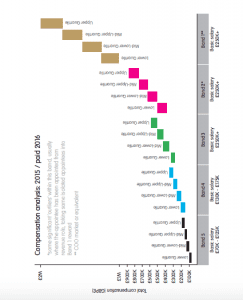

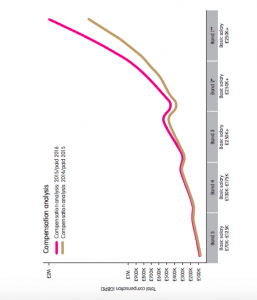

7 Compensation and reward annual review with an adjustment and compensation compression in quarter one 2016.

Compensation for the COO community: 2014–2017 and the inevitability of falling reward

The difficulty of securing reliable compensation data within front office business management is well understood. However, as the 2016 bonus announcements were pending or in the final stages of dissection and allocation, we anticipated compensation across the COO market to be equal at best (and would be down for many at senior director and managing director levels).

In a market segment where no single position matches another, and where the demands on the business management function are increasing and possess greater impact and accountability, getting the reward right is of course fundamental. A bank does not need to be number one in the ‘pay league’, but it does needs to be in sight of the podium to retain the best people. The question for all banks, therefore, is whether the compensation carried forward every year remains competitive. Where relevant, banks need to ask how much weight they should give to counter-organisational dynamics, with many banks still dealing with unsettling periods. This will continue to influence the level of interest people have in looking externally. Many believed the 2016 bonus round would be important in defining the parameters of reward for years to come. It will be interesting to see if there is common ground market-wide in the future.

Looking at the compensation tables (pages 108 and 109), it is easier to get reasonably accurate data at bands 4 and 5 (vice president and director), but it remains a challenge to benchmark managing director bands 1 to 3 accurately. Within this analysis, MD band 1 would be an IB/market COO/divisional board level appointment.

It is worth reiterating the key point about business management being a discipline, and its reward is that it has the greatest disparity in compensation across the banking sector, including some significant outliers at director and managing director level. These exceptions can be paid well above the upper quartile (which have been discounted within our analysis). These outliers are usually found within banks where the business management function and/ or the product COOs are paid directly from the business rather than from a centralised bonus pool or structured framework for compensation. Sometimes the appointee has been moved from a revenue-generating role as part of her or his career development.

The market can make some significant savings by bringing in a level of uniformity across its IB/markets’ COO function (and braver banks looking further into group, as the potential ‘owner’ of the COO function across all divisions) in relation to reward. A more centralised approach on compensation and more specifically issuance/ownership of the bonus pool by the IB/markets’ COO, as opposed to the business or other, would facilitate this process and benefit. This is the model that can be found in almost all principal banks today.