“The global pandemic has shown that local accountability and empowerment is required to ensure business can continue amidst a crisis, running in parallel to corporate directives but with a freedom to not be led wholeheartedly by them.

Governmental laws and orders hold precedence over corporate policies and in this context, since the beginning of the pandemic, the country COO has been empowered to manage the local response, entrusted by necessity to operate autonomously.

The uniqueness and suddenness of the events that unfolded brought into sharp focus the importance of the COO. It is one of the very few roles that truly looks at the business end to end and what this means is the COO’s network is broad and deep, its value has been proven during the pandemic.”

Peter joined Citi in 1987, I met him in 1995 and 27 years later I am still taken by Peter’s calm, considered demeanour; he strikes me as someone who is unflappable. It is undoubtedly this composure that will have been a key attribute in his progressive rise to his present seat. One must imagine this characteristic has been invaluable in the last 18 months, when the COO has been under pressure and scrutiny. Peter, like most COOs, was unceremoniously put on the stage in March 2020 to play a lead role tasked to navigate the Bank’s EMEA operations through troubled waters. This mandate covers Citi’s physical presence in 55 countries.

What has the pandemic taught us about the role of the COO?

“The crisis has emphasised the criticality of the COO’s office. The business heads have had to step up and in doing so have needed to rely more on their COO. It has reinforced the need for the business to understand the COO’s platform and how best to use its central position and influence. Entrustment and empowerment have been the building blocks underpinning success in this relationship. I would add, the more successful COOs throughout the pandemic, would appear to be ones who have been better connected, that had previously nurtured and managed their network, seeing this as a prerequisite of being effective in role. An additional consequence of this extended colleague interaction is the development of a better understanding of the business (end to end).”

Whilst the COO community has been tested more than any other time in a generation, Peter believes the selection criteria of COOs post-pandemic will change little due to the events of the last 18 months. “Some greater attention may be given to attributes of leadership, but the competencies of the COO have always been set by the passage of time. The COO needs to be fit for purpose, to meet the technical and behavioural requirements imposed upon them at any given time. Therefore, in the future we will arguably need a COO that is stronger in technologies or risk management. This was the direction of travel before the pandemic, which may have accelerated this trend but not defined it, although to be truly effective you will still need broad-based experiences to draw upon.”

“I imagine the COO will remain focused principally on people, process, services and technologies?” I asked, Peter nodded, “Yes, but then you need to be able to translate and transfer your experiences to deliver on these responsibilities. It will always be about franchise management, protection, governance, controls, regulation, and remediation. You will always need to be a decathlete as opposed to being excellent in one discipline.”

What of the future, how do you see the distribution of the COO’s time and effort?

“The COO must drive the business. You are expected to support strategic planning, not necessarily its formation but understand its priorities and be prepared to own its execution. However, I do believe the mandate is likely to become broader, which will mean the COO will need to work with and dovetail into other business functions more readily and deeply. Building and maintaining relationships and the ability to influence are already aptitudes needed to be successful as a COO, but it is highly likely this competency will be needed on and above its use today.”

It was agreed the COO will always have a handle on and dedicate time and resources to the regulatory agenda and controls and remediation programmes. These areas will remain part of the COO’s role, but advancements in organisational design and technologies means whilst the need will remain, the amount of time expended by the COO on these matters should decline.

What new challenges are emerging that will fall into the COO’s office?

“Non-financial risk is a growing area of importance. The ability to understand and translate this risk has been shown by the industry’s lack of preparation for the pandemic, made the more surprising that this risk was well known. It is a point of debate where this responsibility should sit, some deferring to the CRO, but the expectation set by the regulators is that where risks need to be understood and owned it is in the business, where the CRO and their risk functions are to oversee and challenge. For example, pre-pandemic people concentration in countries would have been noted but translating this into an understanding of its possible implications is a step and capability that needs to be established. You can extrapolate this into geo-political risk and its translation, just as cyber, reputational risks and so on will need to be managed as one and holistically, this naturally fits in the COO’s office”.

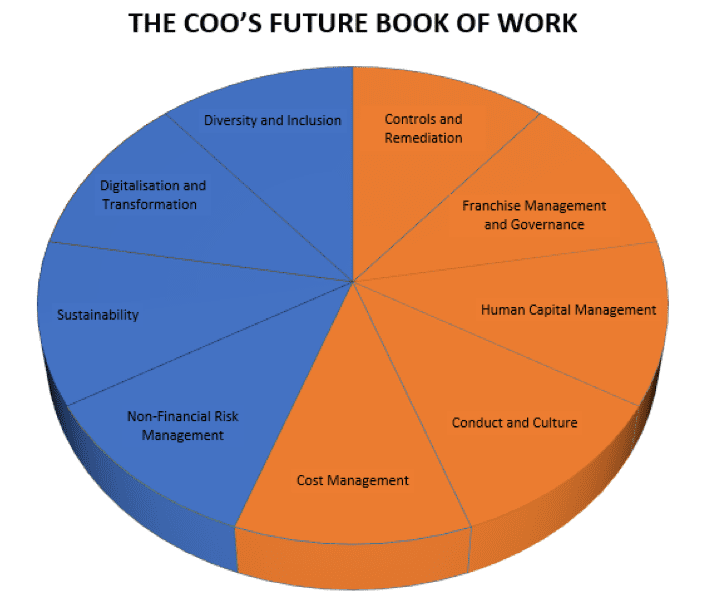

Reference:

Orange – BAU: established responsibilities that will remain key deliverables

Blue – CTB: emerging responsibilities that will require significant input in establishing a capability in each field. The assumption drawn from the chart is that competencies related to risk management and technology would be advantageous and needed to enable the COO to execute as expected in the future.

Why should you aspire to be a COO?

“If you seek a role with the broadest amount of influence, a role that requires you to look across the entire business and to have a position that has meaningful impact, the COO role is a good career destination.

Skills to be successful can be developed, keeping in mind that you will need the broadest skillset you can muster; you will need to be curious, engaged, measured, and have terrific influencing skills.

The challenge for any COO is how to bring the organisation together to maximise its performance, in doing so to create shareholder value, where the best operations and businesses are strengthened by integrity and a leadership committed to doing the right thing. You must possess these characteristics and beliefs but also be broad-minded, culturally aware and be willing to and desire to lead by example.

In a global organisation you should not underestimate the challenge of getting each person to take a small step towards an objective, as opposed to one person taking one big step. The sense of achievement in mobilising and moving the entire organisation is what keeps me engaged and excited about what I do.

99% of the time it is the best job in banking, 1% of the time it’s the absolute worst. Not a bad balance to have!”

Peter McCarthy

EMEA CAO, Citi

Peter has spent most of his career with Citigroup working in Finance, Operations & Technology and Sales & Trading. He is currently Citi’s Chief Administrative Officer for the Europe Middle East & Africa region.

Before joining Citi he qualified as a Chartered Accountant with Deloitte and was European Financial Controller at Merrill Lynch.